Navigating the complex and multifaceted world of corporate finance is a daunting task, especially for Small and Medium Enterprises (SMEs). Given the unique challenges that these businesses face, understanding the essentials of corporate finance can be pivotal to their survival and growth. Crucially, seeking professional advice at an early stage of this process can mean the difference between financial stability and instability.

The Essentials of Corporate Finance for SMEs:

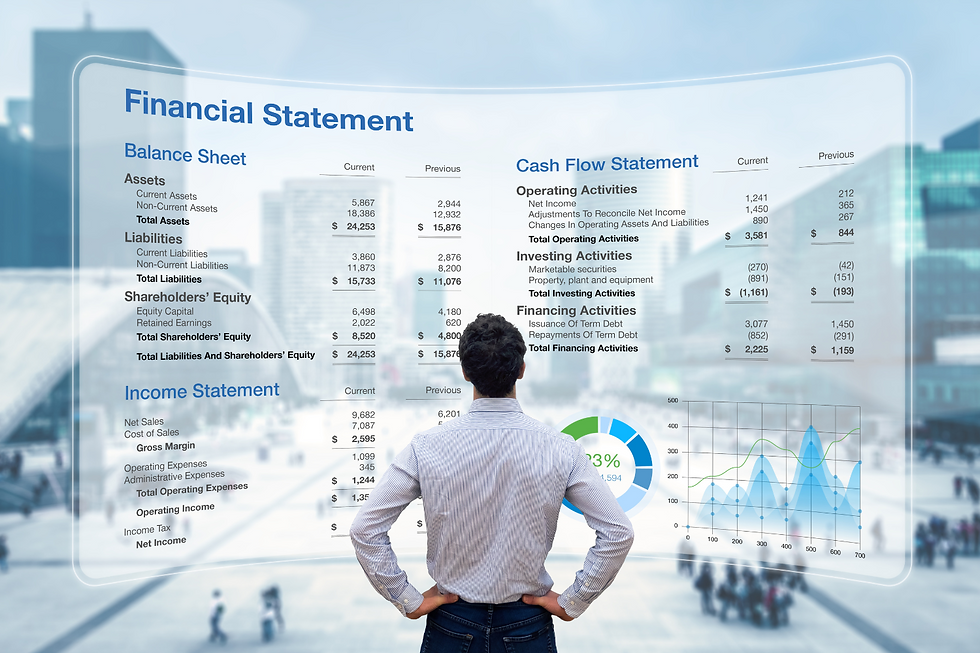

Cash Flow Management: Cash flow is the lifeblood of any business. Effective management involves tracking cash inflows and outflows, forecasting future cash requirements, and ensuring sufficient liquidity to meet short-term obligations. For SMEs, this often means implementing robust bookkeeping systems and making strategic decisions about when to invest in growth opportunities.

Capital Structure: The capital structure of a company refers to how it finances its operations and growth, using a mix of debt, equity, and retained earnings. SMEs must find an optimal balance that aligns with their risk tolerance and growth ambitions, while also ensuring their debt obligations do not undermine their financial stability.

Risk Management: SMEs often operate in a volatile business environment. Hence, they need to proactively identify, assess, and manage a range of financial risks. This could include credit risk, interest rate risk, foreign exchange risk, and more. A solid risk management strategy will provide a safety net for SMEs against potential financial pitfalls.

Investment Appraisal: All businesses, irrespective of their size, must assess the potential profitability of their investments. SMEs should rigorously evaluate potential projects through techniques like Net Present Value (NPV), Internal Rate of Return (IRR), or payback period analysis. These methods will help to ensure that capital is allocated wisely to yield maximum returns.

Working Capital Management: Working capital refers to the funds that a business uses for its day-to-day operations. SMEs need to manage their receivables, payables, and inventory effectively to maintain a healthy working capital balance, essential for smooth business operations.

The Importance of Early Professional Advice:

Engaging with professional financial advisors from the outset can significantly enhance the financial understanding and capabilities of an SME. Advisors bring extensive experience and objective insights to the table, which can help businesses avoid common financial mistakes and recognise potential opportunities and threats.

Moreover, professionals can provide tailored advice to suit the unique needs and circumstances of each business, from determining the most efficient capital structure, to developing effective risk management strategies, to ensuring compliance with financial regulations.

Conclusion: The Indispensable Role of Early Professional Advice

While the complexities of corporate finance can seem overwhelming, they are not insurmountable challenges for SMEs. By understanding the essentials of corporate finance and seeking professional advice early in the process, SMEs can create a strong financial foundation to support their strategic goals and ambitions.

Remember, financial health is not an end in itself, but a means to achieve your business objectives. And a robust understanding of corporate finance, facilitated by expert advice, can help you to navigate the financial landscape confidently and effectively.

So, whether you're starting a new business, looking to expand, or simply want to improve your financial management, we urge you to seek professional advice sooner rather than later. Your future self – and your business's balance sheet – will thank you.

Comentarios